How breaking down the silos between finance and project management unlocks strategic alignment, financial discipline, and measurable value creation

The Silent Disconnect

Your CFO meticulously plans the financial future. Your PMO diligently executes projects. Yet somehow, strategic initiatives consistently miss their financial targets, transformation programs drain resources without delivering expected returns, and nobody can quite explain where the value went.

This isn’t a failure of effort — it’s a failure of collaboration.

In most organizations, the Chief Financial Officer and the Project Management Office operate in separate orbits. Finance sets budgets and tracks spending. The PMO manages timelines and deliverables. They share updates in quarterly reviews but rarely collaborate on the decisions that matter most: which projects to fund, how to measure their value, and when to pivot or kill initiatives that aren’t delivering.

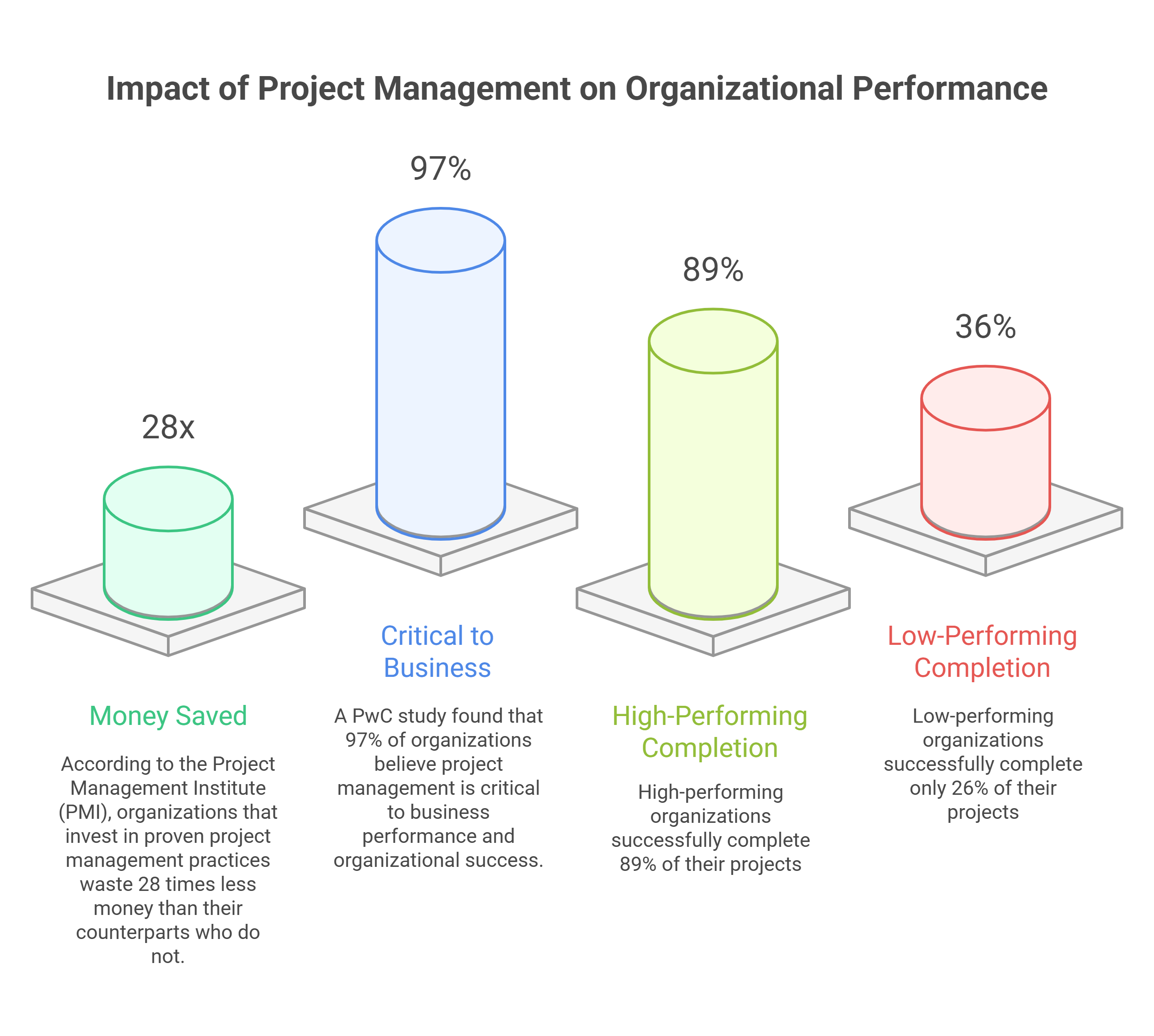

This siloed approach is expensive. Organizations waste approximately $122 million for every $1 billion invested in projects due to poor performance. The gap between strategy and execution isn’t just frustrating — it’s a massive value leak that’s bleeding your competitive advantage.

A new paradigm is emerging: a strategic partnership between the CFO and PMO that bridges the chasm between financial planning and project execution, unlocking immense value and driving genuine strategic alignment.

Two Sides of the Same Coin

To understand the power of this partnership, we must first appreciate the distinct yet complementary roles these functions play.

The Strategic Project Value created when financial discipline meets operational rigor.

This ensures projects are not just finished, but actually deliver the promised ROI and business benefits.

The CFO: Strategic Financial Architect

The modern CFO is far more than a number cruncher. They’re a key strategic partner to the CEO, responsible for the organization’s overall financial well-being. Their mandate extends beyond traditional accounting to include:

- Strategic Financial Planning: Guiding the organization’s financial future through forecasting, budgeting, and long-range planning that shapes strategic direction.

- Capital Allocation: Determining the most profitable and strategically aligned use of the organization’s capital — deciding where to invest for maximum return.

- Risk Management: Identifying and mitigating financial risks that could derail performance or damage reputation.

- Shareholder Value: Ensuring that all financial decisions and investments contribute to maximizing shareholder value and long-term sustainability.

- Business Transformation: Increasingly, CFOs lead transformation initiatives, ensuring they’re financially sound and deliver expected returns.

The PMO: Engine of Execution

The PMO is the central hub for project management within an organization. Its primary role is ensuring projects are executed efficiently, effectively, and in alignment with strategic objectives. A mature, strategic PMO’s responsibilities include:

- Project Portfolio Management: Selecting, prioritizing, and managing the organization’s project portfolio to align with strategic goals and deliver maximum value.

- Standardization: Establishing and maintaining project management standards, methodologies, and best practices to ensure consistency and quality across all projects.

- Resource Management: Optimizing allocation and utilization of resources — people, budget, and technology — across the project portfolio.

- Performance Monitoring: Tracking project performance against key metrics and providing timely, accurate reports to stakeholders.

- Benefits Realization: Ensuring projects deliver intended business benefits and that value created is measured and tracked throughout the lifecycle.

The Value Unlocked Through Partnership

When the CFO and PMO move beyond transactional interactions to forge a true strategic partnership, organizations unlock powerful benefits:

Enhanced Strategic Alignment

Working together, the CFO and PMO ensure the project portfolio directly aligns with strategic and financial goals. This eliminates “pet projects” and ensures resources flow to initiatives that deliver the greatest value.

Improved Financial Performance

A strong CFO-PMO partnership leads to better financial decision-making throughout the project lifecycle — more accurate budgeting and forecasting, improved cost control, and sharper focus on ROI.

Optimized Resource Allocation

By collaborating on project selection and prioritization, the CFO and PMO ensure resources are allocated to the most critical and valuable initiatives, eliminating resource conflicts and maximizing returns.

Better Risk Management

The CFO brings deep understanding of financial risk; the PMO has visibility into project-level risks. Together, they develop comprehensive risk management approaches that mitigate both financial and execution risks.

Increased Agility

In today’s fast-paced environment, adaptability is critical. A strong CFO-PMO partnership enables faster, more informed decisions about the project portfolio, allowing organizations to pivot quickly in response to changing market conditions.

Building a Finance-Savvy PMO

A key enabler of successful CFO-PMO partnership is a strong financial culture within the PMO. Project managers must think like business owners, deeply understanding the financial implications of their decisions.

1. Develop a Financial Acumen Framework

Define the specific financial skills and knowledge project managers need at different seniority levels. This framework should cover:

- Financial Planning & Analysis: Developing and managing project budgets, forecasting costs, and analyzing financial performance

- Business Case Development: Articulating expected costs, benefits, and ROI compellingly

- Financial Metrics: Deep understanding of NPV, IRR, Payback Period, and how to use them to evaluate projects

- Risk Management: Identifying, assessing, and mitigating financial risks throughout the project lifecycle

- Contract Management: Understanding financial implications of contracts and managing them effectively

2. Provide Targeted Training

Once competencies are defined, develop targeted training programs:

- Formal Courses: Project finance, budgeting and forecasting, risk management

- Workshops: Led by finance professionals sharing expertise and practical insights

- Mentoring: Pairing project managers with finance professionals for one-on-one guidance

- Job Rotation: Giving project managers opportunities to work in finance to understand financial processes

3. Integrate Financial Discipline into Processes

Embed financial considerations into all project management processes:

- Project Selection: Using rigorous processes to evaluate proposals based on strategic alignment and financial viability

- Project Planning: Developing detailed budgets and financial plans aligned with business cases

- Project Execution: Tracking costs and performance against budget, taking corrective action as needed

- Project Closure: Conducting post-project reviews to assess financial performance and identify lessons learned

The Collaborative Workflow: Strategy to Execution

A strong CFO-PMO partnership is built on clear communication, shared goals, and collaborative workflows. Here’s how these functions work together:

Strategic Planning

- CFO’s Role: Works with executives to develop strategic and financial goals

- PMO’s Role: Provides insights into organizational capacity to execute strategic initiatives

- Collaboration: Ensure the strategic plan is realistic, achievable, and supported by clear financial planning

Project Portfolio Management

- CFO’s Role: Provides financial parameters for the portfolio, including overall budget and required ROI

- PMO’s Role: Manages intake and prioritization, evaluating proposals against strategic alignment, financial viability, and resource availability

- Collaboration: Select and prioritize projects together, ensuring the portfolio is balanced and aligned

Capital Budgeting and Funding

- CFO’s Role: Approves funding for projects based on business cases and expected ROI

- PMO’s Role: Works with sponsors to develop detailed business cases and financial plans

- Collaboration: Ensure funding decisions are based on rigorous, transparent processes

Project Execution and Monitoring

- CFO’s Role: Monitors overall financial performance, tracking budget variance and ROI

- PMO’s Role: Monitors individual project performance against schedule, budget, and scope

- Collaboration: Identify and address issues or risks impacting financial performance

Benefits Realization

- CFO’s Role: Ensures projects deliver expected financial benefits and value is tracked

- PMO’s Role: Works with teams to identify and track benefits, ensuring alignment with business cases

- Collaboration: Develop benefits realization frameworks and communicate value clearly to stakeholders

The Maturity Journey

The CFO-PMO partnership typically evolves through distinct stages:

- Level 1 - Reactive: Minimal collaboration, primarily transactional interactions focused on budget approvals and financial reporting

- Level 2 - Functional: Regular communication established, basic financial metrics tracked, but limited strategic alignment

- Level 3 - Strategic: Proactive collaboration on portfolio decisions, integrated planning processes, shared accountability for outcomes

- Level 4 - Optimized: Fully integrated partnership, real-time financial visibility, continuous value optimization, predictive analytics driving decisions

Most organizations operate at Level 1 or 2. The organizations that reach Level 3 and 4 gain significant competitive advantages through superior capital allocation and faster, more confident decision-making.

Real-World Impact

While direct case studies on CFO-PMO partnerships are emerging, the pattern is clear in successful transformations:

- A large manufacturing company struggled with R&D projects consistently over budget and behind schedule. By creating a strategic PMO and fostering closer partnership with finance, the company improved project selection and prioritization, significantly increasing ROI on R&D investments.

- A financial services firm facing intense competition needed to accelerate digital transformation. The CFO and PMO head developed a new governance model for technology projects with rigorous business case development and greater focus on benefits realization. This resulted in a more agile approach to technology investment and significant competitive improvement.

- A healthcare organization undertaking a major EHR implementation established a joint CFO-PMO steering committee with representatives from finance and clinical operations. This collaborative approach ensured the project delivered on time, on budget, and achieved expected clinical and financial benefits.

Building Your Partnership

Ready to forge a stronger CFO-PMO partnership? Start with these steps:

- Establish Regular Touchpoints: Move beyond quarterly reviews to weekly or bi-weekly strategy sessions focused on portfolio decisions and value realization.

- Create Shared Metrics: Develop KPIs that both functions own jointly, portfolio ROI, benefits realization rate, strategic alignment scores.

- Invest in Financial Literacy: Build financial acumen across the PMO through structured training and mentoring programs.

- Implement Integrated Tools: Use platforms that connect project execution to financial outcomes in real-time, eliminating the gap between operational and financial data.

- Co-own the Business Case: Make business case development a collaborative process where both finance and project teams contribute and remain accountable.

A Powerful Alliance for Competitive Advantage

In an increasingly complex and competitive world, execution capability is the ultimate differentiator. Organizations that can translate strategy into results faster and more efficiently than their competitors win.

A strategic partnership between the CFO and PMO is the bridge that makes this possible, connecting financial ambition with operational reality, ensuring every dollar invested drives measurable value.

The question isn’t whether to build this partnership. It’s how quickly you can forge it before your competition does.

The first step is simple: schedule a joint session between your CFO and PMO leadership to map your current collaboration level and identify three immediate opportunities to work more closely on portfolio decisions.